Course Objective:

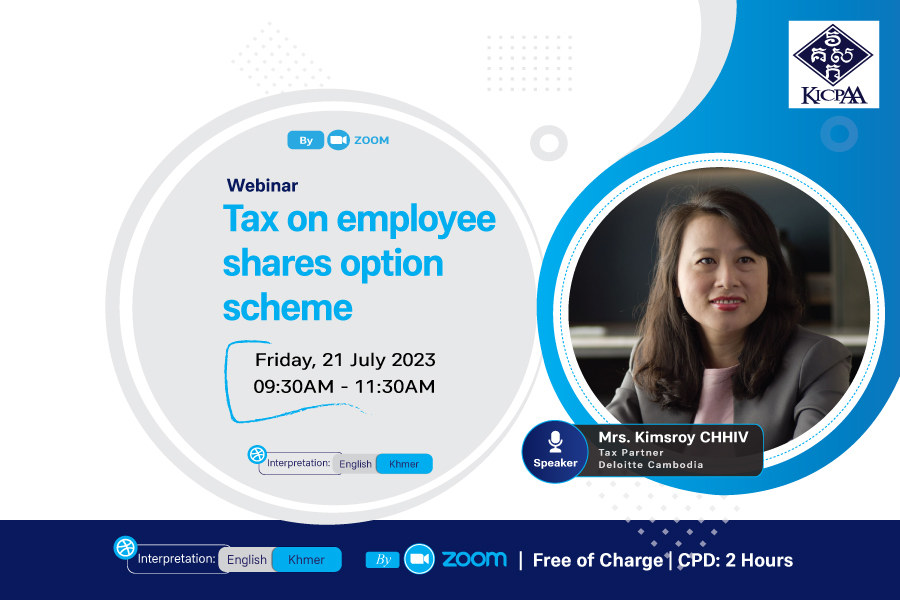

Tax on employee shares option scheme

Course Outline:

- Tax on salary and tax on fringe benefits

- Practice issue

- Challenges from the tax autorities

Mrs. Kimsroy CHHIV

Tax Partner Deloitte Cambodia

Kimsroy has many years of experiences in providing tax and consulting services in Cambodia including tax due diligence and structuring and global trade advisory. She serves numerous clients in various industries such as Consumer Products (CP) including the manufacture, transportation, hospitality and service; Telecom, Media and Entrainment (TMT); Financial Services (FSI) including insurance, real estate and construction. Her experience includes providing tax advice on business operations, corporate structuring to optimize clients’ tax position in Cambodia; conducting tax due diligence projects for mergers and acquisitions and restructurings; and performing tax compliance reviews.

In addition to managing all aspects of tax advisory, M&A and global trade, Kimsroy has extensive experience in assisting clients with their tax dispute resolution with the Cambodia tax authorities. She is closely involved with tax policies in Cambodia including working with government agencies on a number of government initiatives.

Speaker

Contact Information

- Ms. Y Mengchandapich

- Membership Officer

- +855 11 96 33 10 | 77 24 17 07

- info@kicpaa.org

Tax on employee shares option scheme

- Tax on salary and tax on fringe benefits

- Practice issue

- Challenges from the tax autorities