INTRODUCTION

Consolidated financial statements (group accounts) are the main domain of corporate reporting and their preparation, presentation and auditing are a key task of accountants and auditors. This task requires a good grasp of the underlying financial reporting principles and demands competent technical skills in the application of the principles. This 1-day course is based on IFRS 10 Consolidated Financial Statements, which is known as CIFRS 10 in Cambodia. It is designed to provide a comprehensive coverage of the knowledge and skills in the preparation and presentation of consolidated financial statements. It begins with essential topics and builds on to advanced topics in consolidated financial statements. It emphasizes the appropriate application of reporting principles in consolidating financial statements in a practical context.

Who Should Attend?

- Accountants and auditors

- Finance managers and executives

- Accounting and finance staff

- Stock and credit analysts

- Regulators

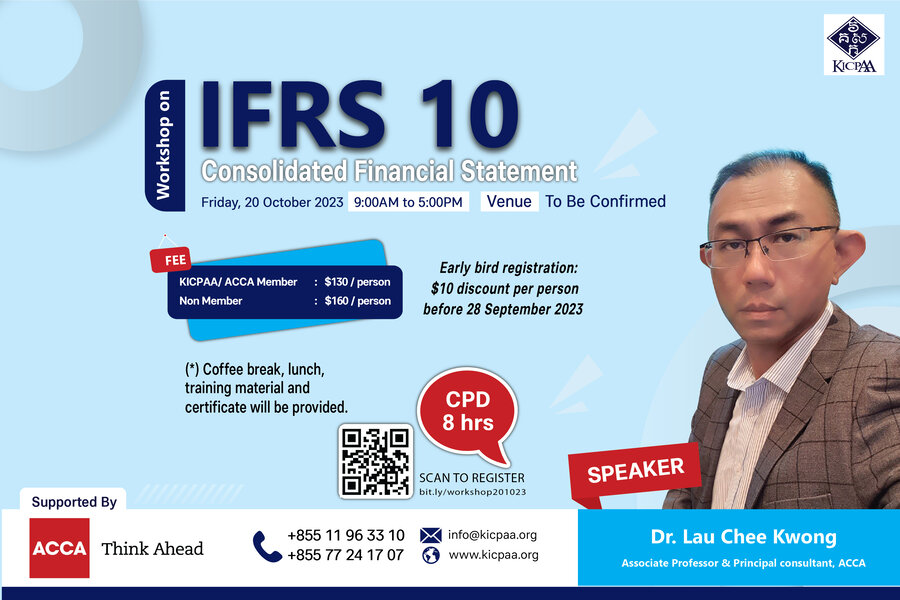

Dr. Lau Chee Kwong

Associate Professor & Principal consultant, ACCA

Dr Lau is Associate Professor of Accounting with the Nottingham University Business School, Malaysia. He is also a principal consultant with CK Business Consulting (Corporate reporting and reporting standards) and Start Now PLT (ESG reporting). He is a renowned and experienced consultant and certified corporate trainer in corporate reporting and reporting standards and owns some best-selling courses in the local accounting profession.

He has more than 30 years of practical experience in financial accounting and corporate reporting, corporate finance, banking management, financial management, investments, academic administration, lecturing, corporate training and consultation work. He conducts training, lectures, and seminars for in-house corporate clients as well as public courses in IFRS/IFRS for SMEs/IPSAS, sustainability reporting, reporting ethics and fraudulent financial reporting, etc.

Dr Lau’s 20 years of industrial exposure includes client research, training and consultation, covering various sectors, namely banks, financial services, education, automobile assembly, telecommunication, manufacturing, media, plantation, outsource, etc. His recent projects related to IFRS (adopted as MFRS in Malaysia and SFRS in Singapore) mainly focus on

– the transition to IFRS, companies transiting from the national reporting standards or IFRS for SMEs to IFRS.

– the transition to IFRS for SMEs, companies transiting from the national reporting standards to IFRS for SMEs.

– the adoption of some recent IFRSs such as IFRS 9, IFRS 15, and IFRS 16.

– the application of IFRS (IFRS for SMEs) in the preparation and presentation of financial statements for group entities.

– the transition to IPSAS (adopted from IFRS), public sector entities transiting from a cash basis to the accrual basis of IPSAS

Dr Lau is a fellow member of the Association of Chartered Certified Accountants (FCCA) and a Chartered Accountant of the Malaysian Institute of Accountants. He is also a fellow member of the CPA Australia from 2008 to 2018. He served as a member of the Issues Committee of the Malaysian Accounting

Speaker

Contact Information

- Ms. Y Mengchandapich

- Membership Officer

- +855 11 96 33 10 | 77 24 17 07

- info@kicpaa.org

This course aims to help participants to:

- Prepare and present consolidated financial statements for reporting entities

- Evaluate and apply the consolidation principles in IFRS 10 and related IFRSs

- Diagnose technical and advanced topics in consolidation of financial statements

- Review and reflect your job in the preparation,

- presentation, and auditing of consolidated financial statements

1. Introduction to business combinations and consolidated financial statements

- IFRS 3 Business combinations, the starting point of consolidation

- Acquirer, control and acquire

- Power and ability to affect variables returns (IFRS 10)

- Acquisition method

- Recognising and measuring the identifiable assets acquired, liabilities assumed and non-controlling interest

- Recognising and measuring goodwill or gain on bargain purchase

2. Consolidating financial statements of a group of companies

- IFRS 10 Consolidated financial statements

- Consolidation procedures

- Intercompany transactions and balances

- Non-control interests (NCI)

- IAS 1 Presentation of Financial Statements

- IAS 7 Statement of Cash Flows

- Consolidation exemption and investment entities

3. Changes in Ownership Structures

- Full and partial disposals, and loss of control

- Reporting remaining interests after disposals

- Disposals or acquisitions with no loss of control: equity transactions